Should You Sell Your Cell Tower Lease?

Every day, property owners across the United States are realizing that they should be paid more money for their cell tower leases. With a free buyout consultation and lease review, clients learn the true value of their property and get paid what they really deserve. Now, you can take advantage of this offer too.

With our free consultation and review you will know exactly how much more money you can earn; you will limit your liability exposure; and you will get the best terms for your cell tower lease buyout.

What Will Rent Rates Be In 2024?

In 2023, cell tower companies and wireless carriers signed cell tower lease agreements with property owners around the United States, for an average of approximately $1,165 per month. The rates paid across the United States varied based upon several following factors. Watch the video to learn more or click here to read the article.

What Is A Cell Tower Lease Buyout?

A cell tower lease buyout is a deal where a company pays a property owner a lump sum of money in exchange for the rights to future cell tower rental income. Instead of the property owner receiving regular monthly or yearly payments for allowing a cell tower on their land, they get one large payment upfront. This can be beneficial for the property owner if they need a large amount of money right away, but it also means they won’t receive any more rent money in the future from that cell tower.

Get More Money For Your Buyout!

Contact Us Today for Your Free Review and Consultation

No cost. No obligation.

Read about us in:

WSJ Spotlights Vertical Consultants - Calls President Hugh Odom the "Property Deal Maker" in its People of 5G Feature

Get Paid More For Your Cell Tower Lease & Don’t Settle For A Bad Offer

Not sure if your offer is good? Here are 3 Insider Tips You Need To Know…

Profit

Companies looking to purchase your cell tower lease have one objective —they need to make a profit. They do this very simply. They buy your cell lease & then re-sell for a higher price. Don’t undersell your lease. Maximize value by selling to not just any party — but to the right party.

Drop Dead Dates

Buyout companies will make so-called one-time offers that have hard drop dead dates that vanish if not acted on by a property owner. These companies are looking only to make you make fast under-informed decisions.

Good for them, bad for you.

Spreading the Payout

A popular tactic by companies who purchase leases is to make offers that will pay you over several years. On the surface it may look like a good deal. It is not. You are not only being effectively paid less than if you took a one-time payment, you may also open yourself up to additional tax burdens.

We got over $500,000 more for our cell tower lease than originally offered. We are very satisfied with our result.

We got over $500,000 more for our cell tower lease than originally offered. We are very satisfied with our result.– Cammie, North Carolina

Have Questions? Need Help?

Once you accept their deal, you may be stuck with it for 20, 30, or even 40 years or more. It will effect you & your family for generations.

Click here to contact an expert. Ask any question. We don’t charge for the consultation and your information is kept confidential.

How are prices determined?

The value is determined by 3 main factors:

1. The price of the land where the cell tower sits

2. The network location of the cell tower

3. The fluidity of cell tower lease market prices

Market prices for communication technology such as cell towers can change daily. A cell phone tower value changes with the market demand. As market prices or market demand increases, the value of a cell tower lease will also increase, and as market demand falls, cell tower lease values will also fall. Due to the changes and advancements in mobile phone technology, and the strong growth in the data plan usage, the market demand has continued to remain very strong.

Your cell tower lease buyout offer is your chance to use your bargaining power. But remember the buyout companies have experts on their side. Shouldn’t you?

We have over 100 years of combined experience. When you hire us to fight for you, we get results.

- A Better Offer

- Our clients on average get over 300% more in rent.

- More Money For Years To Come

- We fight for valuable rent increases.

- Protect Your Land & Your Rights

- Many property owners are suprised when they find out how much control they’ve given up on their land.

Get More Money For Your Buyout!

Contact Us Today for Your Free Review and Consultation

No cost. No obligation.

5 Must-Do’s Before Selling Your Lease

- Basic Lease Terms – Before you venture into considering selling your cell tower lease, you need to make sure you understand the basics of your current lease. The following is a list of the basic lease information you need to know before taking the first step:

- Current rent

- When does the cell tower lease actually expire?

- Who is your actual tenant? Crown Castle AT&T, Verizon, American Tower…

- Escalation clauses – How often and at what rate your rent escalates?

- Right of First Refusal – Do you have this restriction in your lease?

- Consent Obligations – Is there a mortgage on your property that requires consent?

If a company looking to buy your lease provides you a quote for a purchase without reviewing your lease, then there is a good chance that they will not be able to honor the quote.

- Don’t Sell Your Lease Out Of Fear – The majority of cell tower and rooftop lease agreements provide the cell site tenant the right to terminate their lease with as little as 30 days prior written notice. On average, less than 1% of cell sites are decommission each year, with more cell sites being constructed or installed each year than those being terminated. Simply stated, the need for cell towers is not contracting but is expanding. The obvious question is why would any company want to purchase a cell tower lease it if it is going to go away? The answer is also obvious, they know the cell site is not going away, and they can make money off the deal.

- Research Who You Are Dealing With– If you have received a call or email from someone working for a company looking to buy your cell tower lease, the person on the other side of that call or email is usually a commission-based salesperson who usually has very little experience in the actual telecom industry and is subject to the pressures of a very high-pressure sales environment. Most times, you never see them face-to-face, and this may allow them to “stretch the truth” or, even worse, they may try “re-trade” the deal. Re-trading is basically the process of getting you to agree to sell your cell tower lease based upon certain financial terms, but when it comes time to close the deal, they “re-trade” you down on price. Before you go forward with any transaction, you should research the company looking to buy you cell tower lease and, more particularly, the person who has contacted you to see who they are and, more importantly, their background, experience and education as it relates to the cell tower/telecom industry.

- Site Marketing Gimmick– It is difficult for companies that buy cell tower leases, and, more particularly, the salespeople who work for them, to get cell tower landlords to sell their leases. As a result, these companies, and their salespeople, are just a “gimmick”, and that gimmick is telling property owners that they can add tenants to the cell tower on their land. If a property owner receives this presentation by a company looking to buy their cell tower lease, it is a good indication that the company looking to purchase your lease might make any representation just to get you to sign a deal. First, unless you already have a clause in your current cell tower lease that states you will receive a “rent increase” or “revenue share” for any additional subtenants/wireless carriers that are added to cell tower on your property, you or no one else, including the company looking to buy your lease, has a right to any additional rent no matter how many subtenants are added to the cell site. Simply stated, the only company that can add subtenants to the cell tower is the owner of the tower, and no third-party company looking to buy your lease has any influence on who can lease space on the site.

- Where Does Your Lease End Up– Lease buyout companies often will put on a good “Dog and Pony Show” about their company, the amount of cell site leases they have purchased, or how much financial backing they have. However, those representations are used to get you and your cell tower lease in the front door. But the real question is will you and your cell site lease go through the one company’s front door and out the back door to another company? Most companies that purchase cell tower leases sell the leases they buy lease directly to Wall Street or back to the company that is leasing your land. The large private equity companies that fund lease buyout companies don’t want to hold these assets in long-term, and, as a result, they bundle your cell tower lease up with hundreds of others into a single large portfolio instrument and sell that instrument to raise more money or just to cash out their profits.

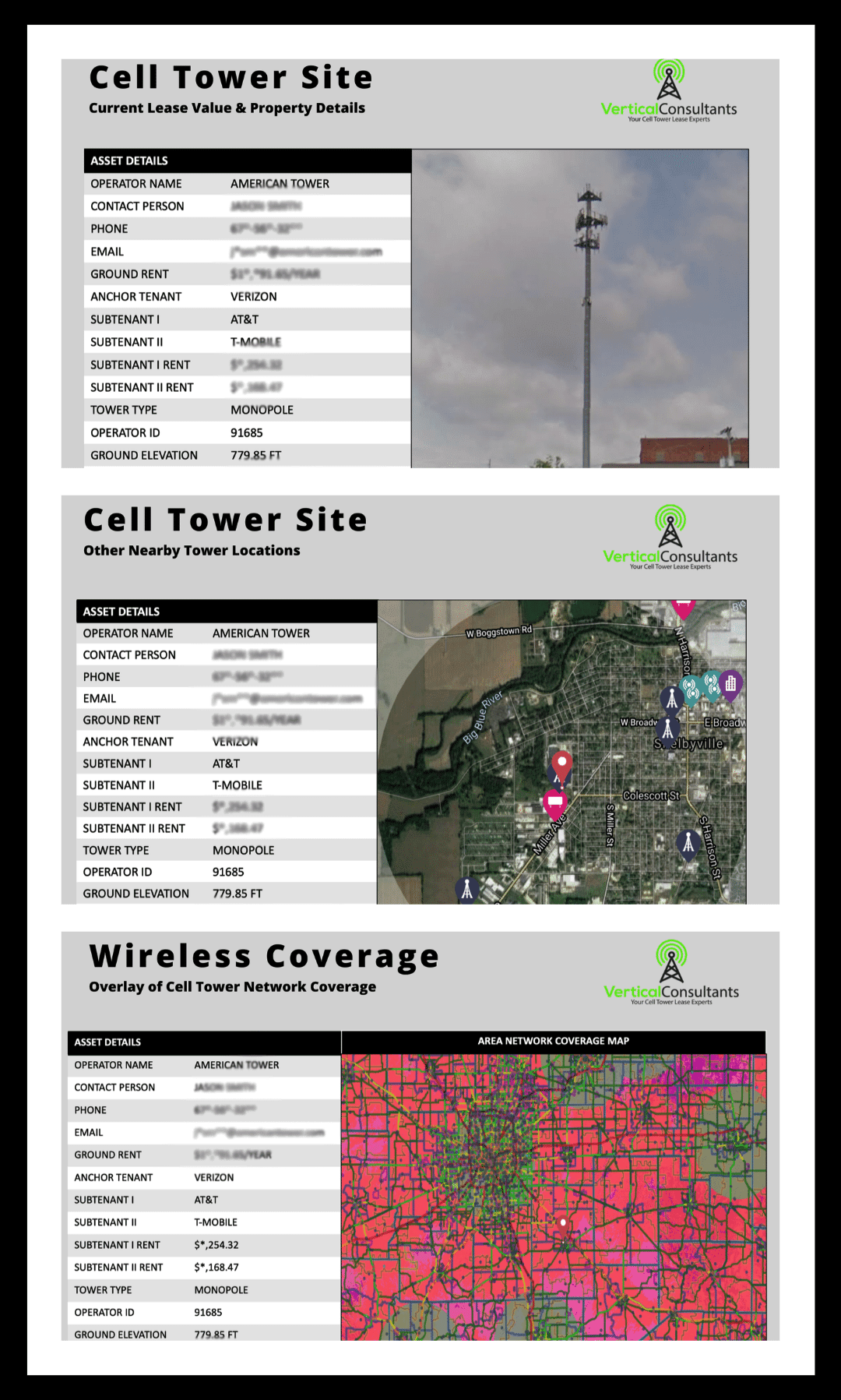

Cell Tower Data - Level The Playing Field

WARNING: THIS IS INSIDER INFORMATION THAT CELL TOWER COMPANIES DON’T WANT YOU TO KNOW

Cell tower companies have access to information that property owners do not and, for years, they have done everything to limit a property owner’s access to this information

Vertical Consultants has access to information related to over 250,000 cell sites across the United States. These cell sites include ground leases, rooftop sites, water tower and utility sites and even sites on billboard and other structures.

Simply stated, the information that Vertical Consultants can provide is exactly what a cell tower company does not what property owners to know when negotiating a new lease or re-negotiating an existing one.

Contact us today to learn more about not only the information we have available, but how we can use that information to make sure you get the best overall cell tower agreement possible.

Assisted with American Tower – Cell Tower Lease Buyout offer

Read More

How We Help With Your Buyout

We are not here to advise you to sell your existing cell tower lease, although, if that is a choice you wish to make, we will make sure you get the true value for your cell tower lease. At the same time, we will make sure you do not enter into an agreement that will have a negative impact on your property.

The goal of most companies that buy cell tower leases is to re-sell those same leases to other companies, including the same tower companies and wireless carriers that are your tenants.

“American Tower wanted to purchase my lease, Vertical Consultants had the expertise to deal with a powerhouse like American Tower and their lease buyout offer.”

“American Tower wanted to purchase my lease, Vertical Consultants had the expertise to deal with a powerhouse like American Tower and their lease buyout offer.”– Keith, Montana

Review the Lease – We will evaluate the terms of your tower lease and determine what the real value of your lease is and what options you have to maximize its value.

Assess Your Cell Site – We understand that the value of your cell tower lease should not be determined by the rent you’re being paid, but by the value of the cell tower site to your tenant. We don’t rely on historical data to determine value. Why? Because this data is historically “bad” when it comes to determining true value of the cell tower site to the cell tower company. We analyze your cell site to determine how much the tower company has vested in the site, the revenues being derived from the site, and the replacement costs for the cell tower owner if they can’t secure the site long term.

Evaluate Buyout Terms – Vertical Consultants will evaluate the buyout proposal and determine how much your lease is really worth. We assess the value of your lease not based on what others have been paid. Why? Because your cell tower lease and tower site is unique and the impact of such a transaction on your land is different than it may be to another property owner. We understand that you want to maximize the value of your cell tower lease, but also realize that you want to limit what you are giving up in return.

Implement a Strategy – Based on our analysis of the unique features that can affect the value of your cell tower lease, we will recommend a strategy of how you should proceed. This will include whether or not you should continue with a lease buyout, and if so, for how much. We will clarify the pros and cons of entering into an agreement with anyone looking to purchase your lease.

If you determine that you want to sell, we find the best company to purchase your lease, negotiate terms on your behalf, and structure all agreements related with the transaction so that you are are protected now and into the future. The buyout companies have experts on their side, shouldn’t you?

We encourage you to contact us today to discuss any cell tower lease buyouts you receive. We will be glad to discuss what services Vertical Consultants can provide you.

Get More Money For Your Buyout!

Contact Us Today for Your Free Review and Consultation

No cost. No obligation.

Avoid These Common Mistakes

Don’t Underestimate the Value of Your Lease

This is the most common mistake that people make when negotiating cell tower lease buyouts. Because there is little to no public information on the true value of cell tower leases, it’s nearly impossible to determine how much you should get paid.

We have spent years (decades actually) negotiating these deals and valuing properties. Put our experience to work for you!

Don’t Ignore the Details of the Terms

Cell tower leases are long-term contracts. They usually last 20 – 40 years and sometimes longer. It may impact your ability to sell your land in the future. Be sure you know exactly what you’re agreeing to before you finalize a deal.

Don’t Make A Rushed Decision

Many lease holders we’ve spoken to have told us that the buyout companies try to create a state of panic. This is one of their tactics. Their goal is to make you more likely to sell your cell tower lease quickly, at a bargain price.

How Do Cell Tower Lease Companies Create Panic?

- They suggest future technologies such as mini or micro cell phone towers will make your cell tower or rooftop equipment obsolete;

- The end is near, meaning that a near term termination of your tower lease is eminent; or

- These same companies seeking to buy a property owner’s cell tower lease will imply there is a pending cell tower consolidation.

Have Questions? Need Help?

Once you accept their deal, you may be stuck with it for 20, 30, or even 40 years or more. It will effect you & your family for generations.

Click here to contact an expert. Ask any question. We don’t charge for the consultation and your information is kept confidential.

HOW IT WORKS

4 Simple Steps To A Better Deal

Our process is simple. It all starts with a free, confidential review of your offer.

We will evaluate the offer to determine if it’s really the best offer for you. Then, we present you with your options. If there is an opportunity to get more money & better terms, we get your permission to go to work on your behalf.

We handle all the negotiations so you have one less thing to worry about.

Send Us Your Buyout Offer For Review

We Evaluate The Terms

We Present Our Findings

We Negotiate On Your Behalf

Who Owns The Land?

Cell tower companies and wireless carriers rarely own the property upon which they construct a cell tower or install rooftop antennas. As a result, these companies preferred method of occupying and using a property is via the entry into a lease agreement with the property owner to allow their cell tower and associated equipment to be operational. The benefit of the bargain is that cell tower companies and wireless carriers get the benefit to construct a tower and lease space to subtenants, or, for a wireless company, it enables them to build out their network, and for the property owner, he or she gets the benefit of receiving revenues set forth under the terms of the cell tower lease.

Components of a Buyout Deal

The transaction usually has two major components. The first being an assignment of the right to collect rents from the property owner to the company purchasing the cell tower lease. Secondly, the property owner usually conveys an interest in the areas being leased by the cell tower company or wireless carrier by way of granting an easement to the company buying the lease rights.

A cell tower lease buyout is similar to a real estate transaction, like selling your house, where the particular terms of the buyout transaction are captured in the aforementioned easement and that documentation is recorded in your local recorder’s office, again much like a deed when you have sold your home or other property. The term of the easement can be as little as 20 years or can be over 100 years, sometimes even perpetual in nature.

How do buyout companies structure their agreements?

- Buyout companies want the right to collect the cell tower rents you are currently receiving under the terms of your present cell tower lease

- The cell tower buyout company will expect the right to control your current leased area by way of a long term or perpetual easement.

If you do wish to sell your cell tower or rooftop lease, we can work on your behalf to optimize the net value you receive. We have years of experience in determining what the true value of a cell tower lease is, and what a third-party should be paying for such an asset.

Vertical Consultants will provide you with expert representation that will include not only negotiating on your behalf the maximum buyout for your cell tower lease (in some cases we have been able to garner up to 100% more than originally offered), but we will also assist you in the negotiation of all documentation associated with such a transaction to make sure you not only get the most, but give up at the least. The company buying your lease has experts on their side trying to make the best deal for them, shouldn’t you have the same?

Lease Buyouts – Tax Issues

Vertical Consultants has been contacted several times regarding the tax implications of a cell tower lease buyout. One of the most asked questions from a cell tower or rooftop landlord is, “What are the tax implications if I accept a buyout offer?” The two (2) most common tax issues associated with cell tower lease buyouts are as follows:

- What is the potential tax treatment of proceeds received by a landowner?

- Are proceeds received from a cell tower lease buyout open to placement in a 1031 like-kind exchange transaction?

Capital Gains

Representatives for a cell tower company and/or a lease buyout company looking to buy out your cell tower lease will tell you what the advantages are of selling your lease. One of the advantages they will promote is that proceeds garnered from a cell tower lease buyout transaction will be subject to capital gain tax treatment, which is subject to a considerably lesser rate that your current monthly rent payments, which is commonly treated as ordinary income for taxing purposes.

Vertical Consultants has experts on staff who can assist you in structuring a transaction so that you can optimize the probability that such proceeds will be subject to the most tax-advantageous treatment.

We do recommend to all cell tower landlords that they consult their accountant or tax advisor before they enter into any buyout transaction. Also, please visit the following link to get more information about lease buyouts and their capital gains treatment. (http://www.irs.gov/newsroom/article/0,,id=106799,00.html).

1031 Exchanges

The 1031 Exchange is also known a Like-Kind Exchange and sometimes referred to as a Starker Exchange.

Landowners should be aware that in the sale of an investment property, landowners are able to defer paying capital gains tax until a future date by purchasing a like-kind property within a given time frame. Landowners should recognize that the 1031 Exchange is not a tax-free exchange, as taxes are not able to be avoided. They are simply deferred until a future date. For non-simultaneous exchanges, proceeds from the sale are held in escrow by a qualified intermediary until closing on a new property that meets the requirement under the 1031 Exchange standards.

Vertical Consultants has experts on staff who can assist you in structuring a transaction so that you can avoid making a costly error that could prevent you from taking advantage of this tax deferring filing. We do recommend to all cell tower landlords that they consult with their accountant or tax advisor before they enter into any lease buyout transaction. Also, please visit the following link to get more information about lease buyouts and the ability to defer proceeds received:(http://www.irs.gov/businesses/small/industries/article/0,,id=98491,00.html).

Before you decide to move forward in considering a lease buyout, you need to obtain certain information. The following are questions you need answered before you agree to any lease buyout:

- If the cell tower or rooftop lease can be terminated, why does the tower company want to buy it from me?

- What are the major differences in a lease and an easement, and how will this change the rights and obligations of both the landowner and the cell tower company?

- The cell tower company wants a perpetual easement. What are disadvantages to do this, and how can I avoid any pitfalls surrounding this transaction structure?

- I have been offered a 50/50 split of any new rents. What are the odds I will receive anything, and how do you monitor going forward?

- After I sell the lease, does the purchaser pay any real estate taxes on the property?

- What are the income tax advantages and disadvantages to a lease buyout?

- Can proceeds received from a lease buyout be used in a 1031 exchange?

Free Consultation & Lease Review

We will review your lease or buyout offer for free. If we can help, we will tell you exactly how.

We are the only Accredited firm in the industry (BBB & NASBP Accredited)

We have negotiated over $750,000,000 in cell tower rent.

You deserve to get a fair deal.

Contact

Us

Are you ready to get the most out of your cell tower lease?

Join thousands of clients who have earned over $1,000,000,000 in rent.

CLICK HERE TO WATCH VIDEO

CLICK HERE TO WATCH VIDEO