Crown Castle – 2022 Insider Information

Jay Brown, Crown Castle’s Chief Executive Officer, recently stated that, “We generated significant growth in 2021…. as customers began upgrading their existing cell sites as part of the first phase of the 5G build out in the U.S. We expect elevated levels of tower leasing to continue and believe we will once again lead the industry with the highest U.S. tower revenue growth in 2022.”

In 2021, Crown Castle generated revenue of approximately 5.7 billion dollars.

Crown Castle’s net income in 2021 was approximately 1.15 billion dollars.

Crown Castle’s 2021 revenues grew by $399 million dollars, which represents a 8.2 % increase over revenues for Crown Castle in 2021.

Crown Castle sub-tenant billings increased by $399 million, which was driven by:

- $399 million increase was due to additional subtenants and amendments to existing subtenant agreements and escalations;

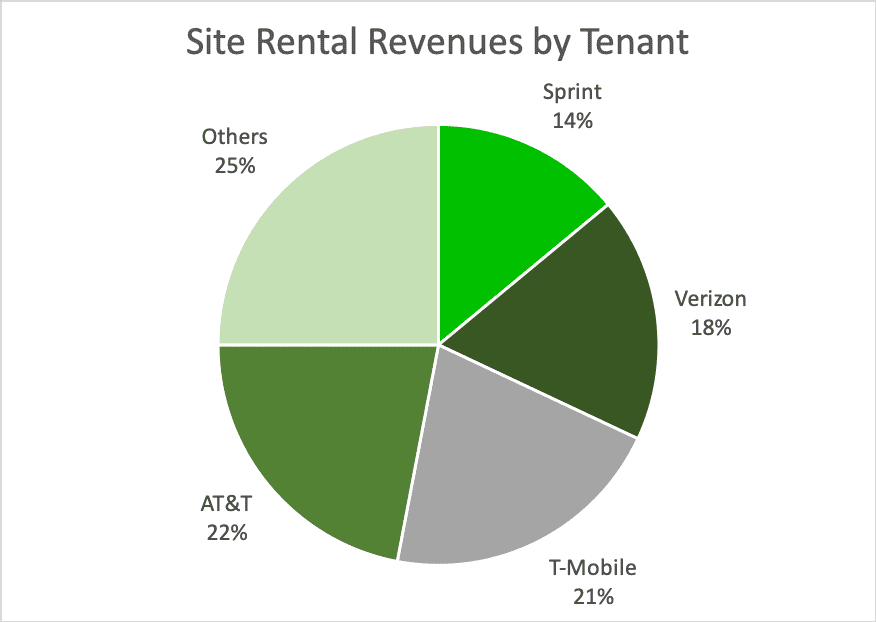

- Crown Castle’s largest tenants are T-Mobile, AT&T, and Verizon Wireless, which collectively accounted for approximately 75% of their 2020 consolidated site rental revenues.

- Crown Castle site rental revenues represented over 80% of Crown Castle’s 2020 consolidated net revenues.

Crown Castle’s rental revenues derived from wireless tenants typically result from long-term tenant contracts with (1) initial terms of five to 15 years, (2) multiple renewal periods of five to 10 years each, exercisable at the option of the tenant, (3) limited termination rights for their tenants and (4) contractual escalations of the rental price and, in some cases, an additional upfront payment.

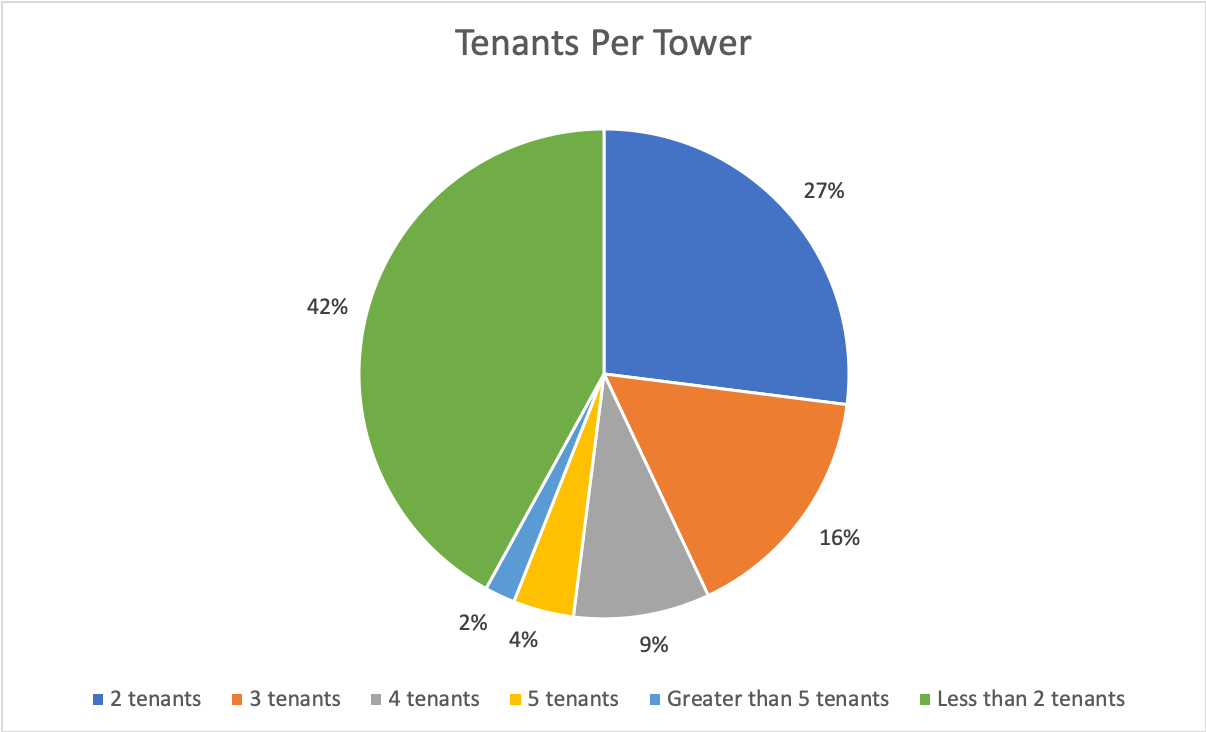

As of December 31, 2021, the average number of subtenants per tower is approximately 2.2. The following chart sets forth the number of existing tenants per tower as of December 31, 2020:

For 2020, Crown Castle site rental revenues by tenant were broken down as follows:

Crown Castle’s ability to retain rights to the land interests on which their towers reside depends on their ability to purchase such land, including through fee interests and perpetual easements, or renegotiate or extend the terms of the leases relating to such land.

Approximately 10% of Crown Castle’s site rental gross margin for 2020 was derived from towers where the leases for the interests under such towers had final expiration dates of less than 10 years.

Crown Castle stated in their recent SEC filing that “if they are unable to retain rights to the property interests on which our communications infrastructure resides, our business may be adversely affected.”

As of December 31, 2021, approximately 53% of Crown Castle towers were leased or subleased or operated and managed under master leases, subleases, or other agreements with AT&T, Sprint and T-Mobile.

Crown Castle has the option to purchase these towers at the end of their respective lease terms, “We have no obligation to exercise such purchase options. In the event that Crown Castle does not exercise these purchase rights, or are otherwise unable to acquire an interest that would allow us to continue to operate these towers after the applicable period, we will lose the cash flows derived from such towers, which may have a material adverse effect on our business.”

Additional information concerning these towers and the applicable purchase options as of December 31, 2021 are as follows:

- Approximately 20% of Crown Castle’s towers are leased or subleased or operated and managed under a master prepaid lease or other related agreements with AT&T for an initial term of approximately 28 years. Crown Castle does have the option to purchase the leased and subleased towers from AT&T at the end of the respective lease or sublease terms for aggregate option payments of approximately $4.2 billion, which payments, if such option is exercised, would be due between 2032 and 2048.

- Approximately 15% of Crown Castle towers are leased or subleased or operated and managed for an initial period of 32 years (through May 2037) under master leases, subleases or other agreements with Sprint which has merged with T-Mobile and will be consolidated. Crown Castle does have the option to purchase in 2037 all (but not less than all) of the leased and subleased Sprint towers from Sprint for approximately $2.3 billion.

- Approximately 20% of Crown Castle towers are leased or subleased or operated and managed under a master prepaid lease or other related agreements with T-Mobile for a weighted-average initial term of approximately 28 years, weighted on Towers site rental gross margin. They have the option to purchase the leased and subleased towers from T-Mobile at the end of the respective lease or sublease terms for aggregate option payments of approximately $2.0 billion, which payments, if such option is exercised, would be due between 2035 and 2049.

The increase in towers site rental revenues was impacted by the following items, inclusive of straight-line accounting: tenant additions across their entire portfolio (tenant additions were influenced by tenants’ ongoing efforts to improve network quality and capacity) renewals or extensions of tenant contracts, escalations and non-renewals of tenants’ contracts.

Crown Castle’s towers operating profit for 2021 increased by $399 million, or 8%, from 2018.

The increase in operating profit was primarily related to the growth in their towers’ site rental revenues and relatively fixed costs to operate the towers.

The information above provides an interesting insight not only on Crown Castle’s overall business model, but the value Crown Castle derives from leasing properties across the United States just like yours.

Remember, Crown Castle has experts working for them, shouldn’t you?

We’re the only firm with telecom and real estate experts all under one roof

Historical Data on Crown Castle Cell Towers

Crown Castle International Corp, d/b/a Crown Castle, is an American corporation that is the largest cell tower owner/developer, owning/operating over 40,000 cell towers in North America and providing coverage to 98 of the top 100 markets.

Crown Castle is headquartered in Canonsburg, Pennsylvania. Crown Castle operates in the United States, Puerto Rico and Australia and provides mobile telephone coverage to 92% of the Australian population. Crown does lease space to wireless service providers, such as Verizon, AT&T, Sprint, and T-Mobile.

On August 31, 2004, Crown Castle completed the sale of its UK subsidiary, Crown Castle UK, to National Grid Transco PLC for $2.035 billion.

On January 12, 2007, Crown Castle completed the acquisition of Global Signal Inc., a rival U.S. tower operator, which was based Florida.

On December 11, 2011, Crown Castle announced a definitive agreement to purchase NextG Networks, Inc. for about $1.0 billion. NextG had over 7,000 distributed antenna system nodes on-air at the time of the agreement, with another 1,500 nodes under construction, as well as rights to more than 4,600 miles of fiber optic cables.

On September 28, 2012, Crown Castle entered a tower leasing agreement with T-Mobile USA. The deal leases 7,200 wireless towers to the company for a term of 28 years in exchange for $2.4 billion. After the deal ends in 2040, Crown Castle may be able to purchase the towers for an additional $2.4 billion.

On October 20, 2013, Crown Castle entered into a tower leasing agreement with AT&T Mobility. The deal leases 9,700 wireless towers to the company for a term of 28 years in exchange for $4.85 billion. Crown Castle also gained the right to acquire the towers outright in the future for $4.2 billion. 600 towers will be acquired outright by Crown Castle in the future. AT&T will pay $1,900 per month to access the towers, with rent rising approximately 2% per year. The towers have an average tenant base of 1.6, signifying that the future collocation potential is high. AT&T portfolio has significantly higher numbers of towers, with less than 20 years remaining until expiration.

During 2013, Crown extended over 1,000 cell tower leases and purchased more than 800 via their lease buyout program. It now controls the land beneath almost 70% of its towers for more than 20 years, with an average term of 29 years remaining on its land leases.

Vertical Consultants continues to advise its clients of the opportunities they have regarding their AT&T lease due to the Crown Castle transaction.

If you have been contacted by Crown Castle, then call us today, and we will review your lease and your tower site to see what options you truly have and how to optimize those options.

Vertical Consultants is always open to providing you with not only references from clients we have assisted, but we will let you speak to them directly.